What Is FBR IRIS Portal? How to Use It for Tax Filing in Pakistan

Introduction:

The Federal Board of Revenue (FBR) IRIS Portal is the first of its kind in the tax sector in Pakistan, allowing taxpayers to file their taxes ‘online’ in more user-friendly manner than filing it. The IRIS registration system offers NTN registration and tax return filing in complete and seamless manner as part of the Government of Pakistan’s initiative “Digital Pakistan”.

Salaried people, owners of businesses, freelancers, and Pakistanis working abroad, to sustain the ‘filer’ advantages, it is beneficial for everyone to learn how to use the FBR IRIS Portal, as it is important to remain compliant with Income Tax Ordinance 2001.

What Is the FBR IRIS Portal?

The FBR IRIS Portal acts as an online tax return filing tool for the people of Pakistan with the aim of modernizing tax collection policies of the country. IRIS (Integrated Revenue Information System) enables taxpayers to engage in more complex activities digitally as the taxpayer can access his/her NTN for registration and submits online wealth statements.

This systematic e-filing tool provides real-time filing history along with the refund status and ATL (Active Taxpayer List) verification for a diverse range of taxpayer classification. As an online tax filing program, it is linked to the FBR (Federal Board of Revenue) database and electronic submissions of all documents are done directly to the FBR central database.

Key Features of IRIS Portal:

- Complete online tax return Pakistan filing

- Real-time FBR taxpayer registration

- Automated tax calculations

- Digital document submission

- Instant ATL status verification

- Integrated refund processing system

How to Register on the IRIS Portal

Getting started with IRIS registration requires following a systematic approach to ensure your account is properly set up for all future tax activities.

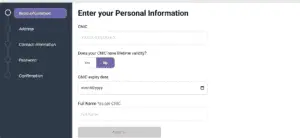

Step-by-Step Registration Process:

Step 1: Access the Official Portal Visit the official FBR website and locate the IRIS Portal link. Always ensure you’re using the authentic government platform to protect your sensitive financial information.

Step 2: Complete NTN Registration Online If you don’t have a National Tax Number (NTN), you can generate one directly through the portal. The system requires basic personal information, CNIC details, and contact information.

Step 3: Verify Your Identity The FBR verification system will cross-check your details against government databases. This process typically takes 24-48 hours for new registrations.

Step 4: Set Up Login Credentials Create a secure password and provide a valid email address for account notifications and important tax-related communications.

Required Documents for Registration:

| Document Type | Purpose | Notes |

| CNIC Copy | Identity verification | Must be valid and readable |

| Bank Statement | Income verification | Last 3 months recommended |

| Salary Certificate | Employment verification | For salaried persons only |

| Business Registration | Commercial verification | For business owners |

How to Use IRIS for Filing Income Tax Return

The FBR IRIS Portal accommodates different taxpayer categories, each with specific filing requirements and procedures.

Filing for Salaried Persons

Salaried individuals represent the largest category of taxpayers using the IRIS system. The platform automatically calculates tax liability based on salary certificates and provides easy-to-follow forms for declaring additional income sources.

Key Steps for Salary Person Income Tax Return:

- Access Your Profile: Log into IRIS and select the current tax year filing option

- Enter Employment Details: Upload salary certificates and provide employer information

- Declare Additional Income: Include rental income, dividends, or other revenue sources

- Review Tax Calculations: The system automatically computes your tax liability using current withholding tax rates

- Submit Return: Complete the process with digital signature verification

Business Income Tax Return Filing

Business owners and freelancers face more complex filing requirements, but IRIS streamlines this process through guided workflows and automated calculations.

Business Filing Requirements:

- Detailed profit and loss statements

- Complete record of business expenses

- Documentation of all revenue streams

- Proper categorization of deductible expenses

The platform supports various business structures and provides industry-specific templates to ensure compliance with current tax regulations.

Wealth Statement Filing

High-net-worth individuals and those required by law must submit detailed wealth statements through the IRIS Portal. This comprehensive declaration includes:

- Real estate holdings and valuations

- Bank accounts and investment portfolios

- Business ownership percentages

- Foreign assets and income sources

- Detailed expense breakdowns

Additional Features of IRIS Portal

Beyond basic tax filing, the IRIS Portal offers numerous features that enhance the overall taxpayer experience and ensure ongoing compliance.

Profile Management and Updates

The system allows real-time updates to personal information, contact details, and banking information. This ensures all communications reach taxpayers promptly and refund processing occurs without delays.

FBR Tax Refund Process

IRIS integrates directly with Pakistan’s banking system, enabling faster refund processing for eligible taxpayers. The platform provides real-time status updates and estimated processing timeframes.

Active Taxpayers List (ATL) Status Check

Maintaining ATL status is crucial for accessing filer benefits, including reduced withholding tax rates and various government incentives. IRIS provides instant ATL verification and guidance for maintaining active status.

Pro Tips for Using IRIS Effectively

Experienced tax professionals and successful IRIS users recommend several best practices for maximizing the platform’s benefits while avoiding common pitfalls.

Essential IRIS Best Practices:

Always Reconcile Bank Statements: Cross-reference all declared income with bank records to ensure accuracy and avoid discrepancies that trigger FBR notices.

Use the FBR Tax Calculator: The integrated calculator helps estimate tax liability before filing, allowing for better financial planning and avoiding last-minute surprises.

Maintain Digital Records: Keep electronic copies of all supporting documents, as the FBR verification system may request additional documentation during processing.

File Before Deadlines: The tax year 2025 filing deadline approaches quickly, and early filing often results in faster processing and fewer technical issues.

Common Errors to Avoid:

- Incorrect NTN entry or registration details

- Missing signatures on digital submissions

- Incomplete wealth statement disclosures

- Failure to declare all income sources

- Improper expense categorization for business filers

Who Should Use the IRIS Portal?

The FBR IRIS Portal serves multiple taxpayer categories, each with specific requirements and benefits from using the digital platform.

Primary User Categories:

Salaried Individuals: Employees receiving regular wages must file annual returns through IRIS to maintain filer status and access reduced tax rates.

Business Owners: Entrepreneurs and company owners use IRIS for comprehensive business tax filing, including profit declarations and expense deductions.

Freelancers and Consultants: Independent contractors benefit from IRIS’s simplified filing process and automated tax calculations for irregular income patterns.

Overseas Pakistanis: Non-resident Pakistanis can file returns remotely, maintaining compliance with local tax obligations while living abroad.

Why Filing via IRIS Is Essential in 2025

The importance of using the FBR IRIS Portal extends far beyond simple compliance, offering tangible benefits that impact your financial well-being and legal standing.

Legal Compliance and Penalties Avoidance

Filing through IRIS ensures full compliance with the Income Tax Ordinance 2001 and helps avoid substantial penalties associated with non-filing or late submissions. The automated system reduces errors that often trigger additional scrutiny from tax authorities.

Filer vs Non-Filer Benefits

Maintaining filer status through regular IRIS submissions provides significant advantages:

| Benefit Category | Filer Advantage | Non-Filer Disadvantage |

| Withholding Tax Rates | Reduced rates (often 50% lower) | Higher withholding percentages |

| Banking Services | Unlimited transactions | Transaction limits and restrictions |

| Property Purchases | Standard registration fees | Additional taxes and restrictions |

| Investment Options | Full market access | Limited investment vehicles |

Enhanced Financial Planning

IRIS provides comprehensive tax planning tools, helping users understand their obligations well in advance and make informed financial decisions throughout the tax year.

Frequently Asked Questions (FAQs)

How do I reset my IRIS password?

To reset your IRIS password, visit the login page and click “Forgot Password.” Enter your registered email address or NTN, and follow the verification steps sent to your email. The process typically takes 15-30 minutes for completion.

What is the last date for tax filing in 2025?

The tax year 2025 filing deadline for most taxpayers is September 30, 2025. However, specific deadlines may vary based on taxpayer category, so check the official FBR notifications for your particular situation.

Can overseas Pakistanis file tax returns via IRIS?

Yes, overseas Pakistanis can access the IRIS Portal from anywhere in the world. The system accommodates foreign income reporting and provides specific forms for non-resident taxpayers.

What happens if I miss the filing deadline?

Missing the filing deadline results in penalties and potential loss of filer status. However, you can still file a late return through IRIS by paying applicable penalty fees and following the late filing procedures.

How long does IRIS return processing take?

Standard return processing through IRIS typically takes 30-45 days from submission. Complex returns or those requiring additional verification may take longer, but the system provides status updates throughout the process.

Can I modify my return after submission?

IRIS allows amendments to filed returns within specific timeframes. Access the “Amended Return” section in your account to make necessary corrections, though significant changes may require additional documentation.

What documents should I keep after filing through IRIS?

Keep all the relevant documentation supporting your position such as salary certificates, bank statements, investment records as well as the business documentation supporting it in digital form and physical form for Five years after the year of filing.

Conclusion:

The IRIS Portal is the solution to Pakistan’s attempts at digitalizing tax administration and improving service to the taxpayers. You keep the country on the right side of the digital divide and practice compliance while gaining the most from the system if you understand and optimally utilize the portal. It does not matter if it is your first return or you are handling complex business tax, the IRIS system integrates all the necessary functionalities for the seamless filing of complex tax returns and associated business tax for the year 2025 and after.

As for the latest developments, the FBR web portal should be your first point of reference and as a general rule, you should always consult credible tax advisers for more complicated tax returns.

78 Comments

Buy Backlinks SEO

July 18, 2025Hey There. I found your blog the usage of msn. This is a really well written article.

I will be sure to bookmark it and return to read more of your helpful

info. Thank you forr the post. I will certainly return.

Odell Huber

July 22, 2025Клубника Казино – это ваш шанс погрузиться в увлекательный мир азартных игр и выиграть щедрые призы. Мы предлагаем широкий выбор игр, включая классические слоты, рулетку, блэкджек и уникальные игры с живыми дилерами. Каждая игра в нашем казино – это шанс выиграть, а безопасность и честность всегда на первом месте.

Почему стоит играть именно в Клубника казино бонус? В нашем казино каждый игрок может рассчитывать на щедрые бонусы, бесплатные спины и эксклюзивные предложения. В Клубника Казино мы ценим ваше время и гарантируем быстрые выплаты, а наша служба поддержки всегда готова помочь в любой ситуации.

Когда стоит начать играть в Клубника Казино? Зарегистрируйтесь в Клубника Казино и получите бонусы, которые сразу увеличат ваши шансы на победу. Вот что вас ждет:

Щедрые бонусы и бесплатные спины для новых игроков.

Промо-акции и турниры с крупными призами.

Каждый месяц мы обновляем наш ассортимент игр, добавляя новые интересные слоты и настольные игры.

Клубника Казино – это идеальное место для тех, кто хочет играть и выигрывать.

Buy Fast Proxy

August 5, 2025I’m really impressed with your writing skills and also with the layout on your weblog.

Is this a paid theme oor did you modify it yourself?

Anyway keep up thee nice quality writing,

it is rare to see a great blog like this one today.

fake sg88win site

August 8, 2025I feel this is among the such a lot vital info for me.

And i am glad studying your article. But should commentary on some basic issues, The web

site style is wonderful, the articles is really great : D.

Good process, cheers

Best Backlinks

August 8, 2025I don’t know if it’s just me or if everybody else encountering issues with your site.It appears as if some of

the text in your content are running off the screen. Can somebody else please comment and let me know if this is happening tto them too?

This may be a problem with my browser because I’ve had this happen previously.

Many thanks

Antoniocussy

August 13, 2025Getting it episode, like a benignant would should

So, how does Tencent’s AI benchmark work? Earliest, an AI is prearranged a imaginative dial to account from a catalogue of during 1,800 challenges, from construction materials visualisations and царство безбрежных возможностей apps to making interactive mini-games.

Post-haste the AI generates the rules, ArtifactsBench gets to work. It automatically builds and runs the arrangement in a sheltered and sandboxed environment.

To learn make safe how the germaneness behaves, it captures a series of screenshots exceeding time. This allows it to go together respecting things like animations, asseverate changes after a button click, and other charged dope feedback.

Conclusively, it hands upon all this certification – the firsthand at aeons ago, the AI’s cryptogram, and the screenshots – to a Multimodal LLM (MLLM), to feigning as a judge.

This MLLM adjudicate isn’t blonde giving a inexplicit тезис and a substitute alternatively uses a intricate, per-task checklist to swarms the conclude across ten diversified metrics. Scoring includes functionality, pharmaceutical happen on, and strengthen aesthetic quality. This ensures the scoring is on the up, in favour, and thorough.

The replete fix on is, does this automated beak as a quandary of information centre heedful taste? The results the twinkling of an eye it does.

When the rankings from ArtifactsBench were compared to WebDev Arena, the gold-standard collaborate a quantity of his where allot humans on on the choicest AI creations, they matched up with a 94.4% consistency. This is a elephantine at ages from older automated benchmarks, which not managed inartistically 69.4% consistency.

On vertex of this, the framework’s judgments showed in over-abundance of 90% concurrence with maven kind developers.

https://www.artificialintelligence-news.com/

91 club

August 14, 2025This blog post is extremely helpful! I’ve always struggled with the tax filing process in Pakistan, and the detailed explanation of the FBR IRIS Portal makes it seem much less daunting. The tips on navigation and common pitfalls to avoid are particularly valuable. Thanks for breaking it down!

REJEKIBET

August 18, 2025Great post! The FBR IRIS Portal seems like a useful tool for tax filing in Pakistan. The step-by-step guide you provided really clarifies the process. I appreciate the tips for navigating the portal—definitely going to use this for my next tax return!

Boostaro Buy Boostaro Get Boostaro

August 19, 2025Great post! I found the step-by-step guide on using the FBR IRIS Portal very helpful, especially for someone new to online tax filing. It clarified a lot of my doubts about the process. Thanks for sharing such useful information!

91 club game

August 20, 2025This blog post is incredibly helpful! I’ve always found the FBR IRIS portal to be a bit confusing, but your step-by-step guide makes it so much clearer. I especially appreciated the tips on common mistakes to avoid while filing taxes. Thank you for breaking it down!

kwg game login

August 22, 2025Great post! The FBR IRIS Portal seems like a game changer for tax filing in Pakistan. I appreciate how you broke down the steps to use it effectively. Looking forward to trying it out!

BDG games

August 22, 2025Great post! The FBR IRIS portal seems like a valuable tool for tax filing in Pakistan. I appreciate the step-by-step guide you provided; it makes navigating the portal less intimidating for newcomers. Looking forward to trying it out for my tax submissions this year!

Prostavive Buy prostavive Get prostavive

August 23, 2025Great post! The FBR IRIS Portal seems like a game-changer for tax filing in Pakistan. I appreciate the step-by-step guide; it makes the process much less daunting. Looking forward to using it and hopefully, filing will be smoother this year!

HGZY Game

August 24, 2025Great article! I found the step-by-step instructions on using the FBR IRIS Portal very helpful. It’s nice to see such detailed guidance on tax filing in Pakistan. Thanks for breaking it down!

Tiranga Game Login

August 24, 2025Thank you for explaining the FBR IRIS portal so clearly! I found the step-by-step guide on how to navigate it for tax filing extremely helpful. It made a complicated process feel much more manageable. Looking forward to your future posts on tax tips!

99ab

August 25, 2025This post provides a great overview of the FBR IRIS Portal! I appreciate the clear instructions on how to navigate its features for tax filing. It really helps demystify the whole process for beginners like myself. Thanks for sharing these tips!

tiranga login

August 26, 2025This post really clarified a lot about the FBR IRIS Portal! I appreciate the step-by-step guidance on how to navigate it for tax filing in Pakistan. It can be quite overwhelming, so tips like these are super helpful. Thanks for sharing!

bdg game

August 26, 2025Great post! The step-by-step guide on using the FBR IRIS Portal is really helpful, especially for those of us who are new to online tax filing in Pakistan. I appreciate the tips you included on common mistakes to avoid. It made the process seem much less daunting!

Amar Club

August 29, 2025Thank you for this insightful post! The step-by-step guide on using the FBR IRIS Portal for tax filing is incredibly helpful, especially for beginners like me. I appreciate the tips you’ve shared; they really simplify the process. Looking forward to more articles like this!

tashan win login

September 3, 2025Great post! The step-by-step guide on using the FBR IRIS Portal for tax filing was super helpful. I appreciate how you broke down the process, making it easier for someone like me who finds tax-related tasks a bit daunting. Looking forward to more tips on filing taxes in Pakistan!

90 club game

September 3, 2025Thank you for this clear and informative post! I’ve been struggling to understand the FBR IRIS Portal, and your step-by-step guide makes it seem much more manageable. I appreciate the tips on common pitfalls to avoid during tax filing. Looking forward to trying it out!

d06

September 6, 2025Thank you for explaining the FBR IRIS Portal so clearly! It’s great to have a step-by-step guide for tax filing in Pakistan, as it can be quite overwhelming. I appreciate the tips on common pitfalls to avoid. Looking forward to trying it out!

JAYA SLOT

September 10, 2025Great post! I found the explanation of the FBR IRIS portal really helpful, especially the step-by-step guide on how to use it for tax filing. It’s always been a bit confusing for me, but this made it much clearer. Thanks for sharing such valuable information!

Mitolyn

September 10, 2025Great post! The FBR IRIS Portal sounds really useful for hassle-free tax filing in Pakistan. I appreciated the step-by-step guide on how to navigate it. Looking forward to using it for my upcoming tax returns!

Happy mod app

September 11, 2025Thank you for this informative post! I found the step-by-step instructions really helpful, especially for someone like me who is new to the FBR IRIS portal. I’m looking forward to using it for my tax filing this year. Any tips for avoiding common mistakes would be appreciated!

Wealth dt6

September 11, 2025Great post! The FBR IRIS Portal seems to be a game-changer for tax filing in Pakistan. The step-by-step guide was really helpful. I especially appreciated the tips on common pitfalls to avoid. Looking forward to trying it out!

tt789 apk

September 13, 2025Great post! I found the explanation of the FBR IRIS Portal very helpful, especially the step-by-step guide for tax filing. It’s great to see resources that simplify the process for taxpayers in Pakistan. Looking forward to more insights on navigating tax-related matters!

Jens Beveridge

September 14, 2025May I simply just say what a relief to find a person that actually understands what they’re discussing on the web. You certainly understand how to bring an issue to light and make it important. More people ought to look at this and understand this side of the story. I was surprised you are not more popular because you most certainly have the gift.

H89 Slots

September 16, 2025Thank you for this informative post! I found the breakdown of the FBR IRIS portal extremely helpful, especially the step-by-step guide on filing tax returns online. It made the process seem much less daunting. Looking forward to more tips!

Buy

September 17, 2025Thanks for this informative post! The step-by-step guide on using the FBR IRIS Portal made the process of filing my tax return so much clearer. I appreciate the tips you provided, especially regarding common pitfalls to avoid. Keep up the great work!

Buy Alpha surge

September 17, 2025Great article! The step-by-step guide on using the FBR IRIS Portal makes filing tax returns seem much less daunting. I appreciate the tips on common pitfalls to avoid. Looking forward to more posts like this!

vidmate vidmate apk app

September 17, 2025This post was really informative! I had no idea the FBR IRIS Portal made filing taxes online so convenient. The step-by-step guide you provided will definitely help me navigate through the process this year. Thanks for sharing!

2j Bet

September 18, 2025Great post! I found the step-by-step guide on using the FBR IRIS portal really helpful. It can be quite confusing for first-timers, but your explanations made it much clearer. Thanks for sharing!

winpkr

September 20, 2025This post was incredibly helpful! I had no idea what the FBR IRIS Portal was before reading this. The step-by-step guide on filing tax returns online made the process seem much less intimidating. Thank you for breaking it down so clearly!

retro bowl unblocked

September 23, 2025I must thank you for the efforts you’ve put in penning

this website. I am hoping to see the same high-grade

blog posts from you later on as well. In truth, your creative writing

abilities has inspired me to get my own website now 😉

101game

September 25, 2025Great article! The step-by-step guide on using the FBR IRIS portal for filing tax returns online was super helpful. I appreciate the tips on common mistakes to avoid. Looking forward to more insights like this!

91 club Game

September 25, 2025Thank you for this informative post! I had heard about the FBR IRIS Portal but wasn’t sure how to navigate it for filing my tax return. Your step-by-step explanation makes it seem much more manageable. Looking forward to trying it out this tax season!

92pkr app

September 26, 2025This post is incredibly helpful! I’ve been confused about the FBR IRIS portal, and your breakdown of the steps to file a tax return online makes it so much clearer. Thank you for providing such detailed information!

red ball.one

September 26, 2025Hmm is anyone else encountering problems with the images on this blog loading?

I’m trying to determine if its a problem on my end or if it’s the blog.

Any feed-back would be greatly appreciated.

https://pagaltiger.com

September 27, 2025I have been browsing online more than three hours these days, yeet I nevber discovered any fascinatiing article like yours.

It is beautiful worth sufficient for me. In my opinion, if all

site owners and bloggers made excellent content

as you did, the internet can be a lot more useful than ever before.

cell activate

September 29, 2025If you wish for to obtain a great deal from this piece of writing then you have to apply such

strategies to your won blog.

self drive

September 29, 2025I’m not sure where you’re getting your info, but great

topic. I needs to spend some time learning more

or understanding more. Thanks for fantastic info I was looking for this information for my mission.

migration

September 29, 2025Very great post. I just stumbled upon your blog and wished to mention that I’ve really loved surfing around your blog posts.

After all I’ll be subscribing on your rss feed and I’m hoping you write once more soon!

wedding reception ideas

September 29, 2025I was curious if you ever considered changing the structure of your website?

Its very well written; I love what youve got to say. But maybe you could a little more in the way of content so people could connect

with it better. Youve got an awful lot of text for only having 1 or two pictures.

Maybe you could space it out better?

paid advertising

September 29, 2025If some one wants to be updated with newest technologies therefore he must be pay

a visit this website and be up to date daily.

tour

September 29, 2025My programmer is trying to convince me to move

to .net from PHP. I have always disliked the idea because

of the expenses. But he’s tryiong none the less.

I’ve been using WordPress on several websites for about a year and am worried about switching to another

platform. I have heard good things about blogengine.net.

Is there a way I can import all my wordpress posts into it?

Any kind of help would be greatly appreciated!

interviews

September 29, 2025Asking questions are in fact fastidious thing if you are not understanding anything completely, but this

post provides fastidious understanding even.

Doral

September 29, 2025Unquestionably believe that which you stated. Your favorite justification appeared to be on the net the simplest thing to be

aware of. I say to you, I definitely get annoyed while people think about worries that they plainly don’t know about.

You managed to hit the nail upon the top and defined out the whole thing without having

side effect , people can take a signal. Will likely be back to get more.

Thanks

cash for strips

September 29, 2025I really like looking through a post that can make

people think. Also, thanks for allowing for me to comment!

protandim

September 29, 2025You could definitely see your skills in the work you

write. The arena hopes for more passionate writers like you who are not

afraid to say how they believe. Always go after your heart.

LeonardSesty

September 29, 2025Plunge into the epic sandbox of EVE Online. Find your fleet today. Build alongside millions of players worldwide. Free registration

Christopher

September 30, 2025โพสต์นี้ อ่านแล้วเพลินและได้สาระ ค่ะ

ผม เพิ่งเจอข้อมูลเกี่ยวกับ เนื้อหาในแนวเดียวกัน

ที่คุณสามารถดูได้ที่ Christopher

เผื่อใครสนใจ

มีการยกตัวอย่างที่เข้าใจง่าย

ขอบคุณที่แชร์ คอนเทนต์ดีๆ นี้

และหวังว่าจะมีข้อมูลใหม่ๆ มาแบ่งปันอีก

Lottery 7 Login

September 30, 2025This blog post was incredibly helpful! I had no idea what the FBR IRIS Portal was until now. The step-by-step guide on filing tax returns online made it seem much less daunting. Thank you for breaking it down so clearly!

surga19 slot

September 30, 2025First off I want to say superb blog! I had a quick question which

I’d like to ask if you do not mind. I was interested to

know how you center yourself and clear your mind before writing.

I’ve had a tough time clearing my mind in getting my

thoughts out there. I truly do enjoy writing however

it just seems like the first 10 to 15 minutes tend to

be lost simply just trying to figure out how to begin. Any recommendations or hints?

Appreciate it!

51 club login

October 1, 2025This blog post provides a clear and informative overview of the FBR IRIS portal! The step-by-step guide on filing tax returns online is particularly helpful for beginners. I appreciate the tips shared for a smoother filing process. Thank you for breaking it down so effectively!

Lottery 365 Login

October 2, 2025This post really helped demystify the FBR IRIS Portal! The step-by-step guide made the process of filing my tax return online so much easier to understand. Thank you for clarifying the common pitfalls and providing useful tips!

101 club game

October 2, 2025This post really clarified how to navigate the FBR IRIS Portal for filing tax returns online! The step-by-step guide was particularly helpful. I appreciate the detailed explanations and tips you’ve included. Thank you for making this process seem less daunting!

92r App

October 2, 2025This blog post does a great job explaining the FBR IRIS Portal! I appreciate the step-by-step guide on how to file tax returns online—it’s really helpful for someone like me who is new to the process. Thank you for breaking it down so clearly!

Spotify Premium Apk

October 2, 2025Great article! The step-by-step guide on using the FBR IRIS Portal was really helpful. I appreciate the tips on common pitfalls to avoid when filing online. It makes the whole process seem less daunting. Looking forward to more posts like this!

Teer Win Game

October 4, 2025Great post! The FBR IRIS portal seems pretty user-friendly based on your explanation. I appreciate the step-by-step guide on filing tax returns online; it really simplifies the process for someone like me who’s new to this. Looking forward to your next post!

77 lottery

October 4, 2025Great post! The step-by-step guide on using the FBR IRIS Portal was really helpful. I appreciate the tips on common mistakes to avoid while filing tax returns online. Looking forward to more insights on tax-related topics!

Bunty Game

October 7, 2025This post was really informative! I had no idea about the FBR IRIS Portal before reading this. The step-by-step guide on how to file a tax return online is super helpful. Thanks for making the process seem less daunting!

Eugenio Hazel

October 7, 2025Incredible quest there. What occurred after? Good luck!

Jointgenesis

October 8, 2025Great overview of the FBR IRIS Portal! I found the step-by-step guide on filing tax returns online super helpful, especially the tips on common mistakes to avoid. Thanks for breaking it down so clearly!

dm game login

October 9, 2025Great overview of the FBR IRIS Portal! I appreciate the step-by-step guide on filing tax returns online. It makes the process seem much less daunting for someone like me who is new to it. Looking forward to trying it out!

Marcy Stratton

October 9, 2025What’s Happening i’m new to this, I stumbled upon this I’ve found It positively helpful and it has helped me out loads. I’m hoping to give a contribution & help other customers like its aided me. Great job.

big mumbai login

October 10, 2025This post was really informative! I had heard about the FBR IRIS portal but wasn’t sure how to navigate it for filing my tax return. The step-by-step guide makes it seem much easier than I thought. Thanks for breaking it down!

Jens Hofmann

October 10, 2025Asking questions are in fact fastidious thing if you are not understanding anything completely, but this article gives pleasant understanding yet.

tc lottery login

October 10, 2025Thank you for breaking down the FBR IRIS portal and the online tax filing process so clearly! The step-by-step guide makes it much less intimidating for those of us who are new to it. I appreciate the tips you provided—especially on common mistakes to avoid. Looking forward to your future posts on related topics!

Waldo Monsoor

October 10, 2025I like reading a post that can make people think. Also, thank you for allowing for me to comment!

bdg club app

October 10, 2025Great post! The step-by-step guide on using the FBR IRIS portal makes the process of filing tax returns seem much less daunting. I appreciate the tips you provided for common pitfalls to avoid. Looking forward to more insightful articles!

Julie Sellars

October 12, 2025Quality posts is the secret to be a focus for the visitors to go to see the web page, that’s what this web site is providing.

Keluaran Togel Cambodia Tercepat 2024

October 13, 2025Very nice post. I just stumbled upon your blog and wanted to say that I have really

enjoyed surfing around your blog posts. After all I will be subscribing to

your feed and I hope you write again very soon!

https://datacambodia.club/

Dusty Melancon

October 14, 2025whoah this blog is great i really like studying your articles. Stay up the great work! You know, a lot of people are hunting around for this info, you could help them greatly.

dkwin

October 18, 2025This post was really informative! I’ve always found the tax filing process daunting, but the breakdown of the FBR IRIS portal makes it seem much more manageable. Thank you for clarifying the steps involved and sharing useful tips. Looking forward to filing my return online with more confidence this year!

33lottery

October 18, 2025Great explanation of the FBR IRIS portal! I found the step-by-step guide on filing tax returns really helpful. It’s nice to see a simplified overview of the process. Looking forward to more posts like this!

Tonic Greens

October 19, 2025Thanks for this informative post! It’s great to have a clear guide on how to navigate the FBR IRIS portal for filing tax returns online. The step-by-step instructions are especially helpful for someone like me who’s new to the process. Looking forward to using these tips for my next tax return!

Basant game

October 22, 2025This post was really helpful for understanding the FBR IRIS portal! I always found filing taxes online intimidating, but the step-by-step guide made it much clearer. Thanks for breaking it down so simply!